Partnership Announcement:

Welcoming Lido to the Ion Ecosystem — More Secure and Capital Efficient Borrowing for stETH Holders

Intro

We’re excited to welcome Lido, the final member of the first cohort of partners we’ll be supporting on our mainnet launch! As the market leader in the liquid staking ecosystem, we want to ensure we can bring capital-efficient and secure lending and borrowing to the largest staking audience possible.

Let’s explore the significant impact that Lido has had on liquid staking and LSTFi, and how Ion Protocol is positioned to extend stETH’s utility even further.

Lido — Growth and Current Initiatives

Lido has been the predominant issuer of liquid staking tokens (LSTs) over the past year. By depositing ETH in the protocol, users receive a tokenized representation of their stake that can be utilized across various DeFi applications, earning additional rewards. Since its inception in 2020, Lido has reached over 9 million ETH staked.

Lido’s LST is known as stETH and it has surged in popularity due to its support in numerous DeFi applications. Its deep liquidity and history of robust security have made it an exceptional asset to use as collateral.

Recently, Lido has made a concerted effort to reinforce the decentralization of its architecture. These improvements are highlighted in their expansion of the node operator set, an emphasis on supporting robust withdrawals, and continued iteration on DAO decentralization.

One of the more notable recent developments in the pursuit of further decentralization was the introduction of the Simple DVT Module. DVT (Distributed Validator Technology) is a mechanism that enables the decentralization of a single validator’s responsibilities across multiple nodes or parties. It splits the validation process ensuring no single entity has complete control over a given validator’s activities.

The Simple DVT Module leverages infrastructure providers like Obol Network and SSV to add more node operators to the Lido Node Operator set. This introduces more diversity in the operator set while benefiting from increased resilience, decentralization, and security.

Simple DVT and numerous other protocol improvements showcase Lido’s priority on minimizing the impact that slashing events could have on stETH holders. These are all factors that affect how we underwrite stETH and other LSTs in Ion Protocol.

Ion & Lido — Building Economic Incentives Around Provider Improvements

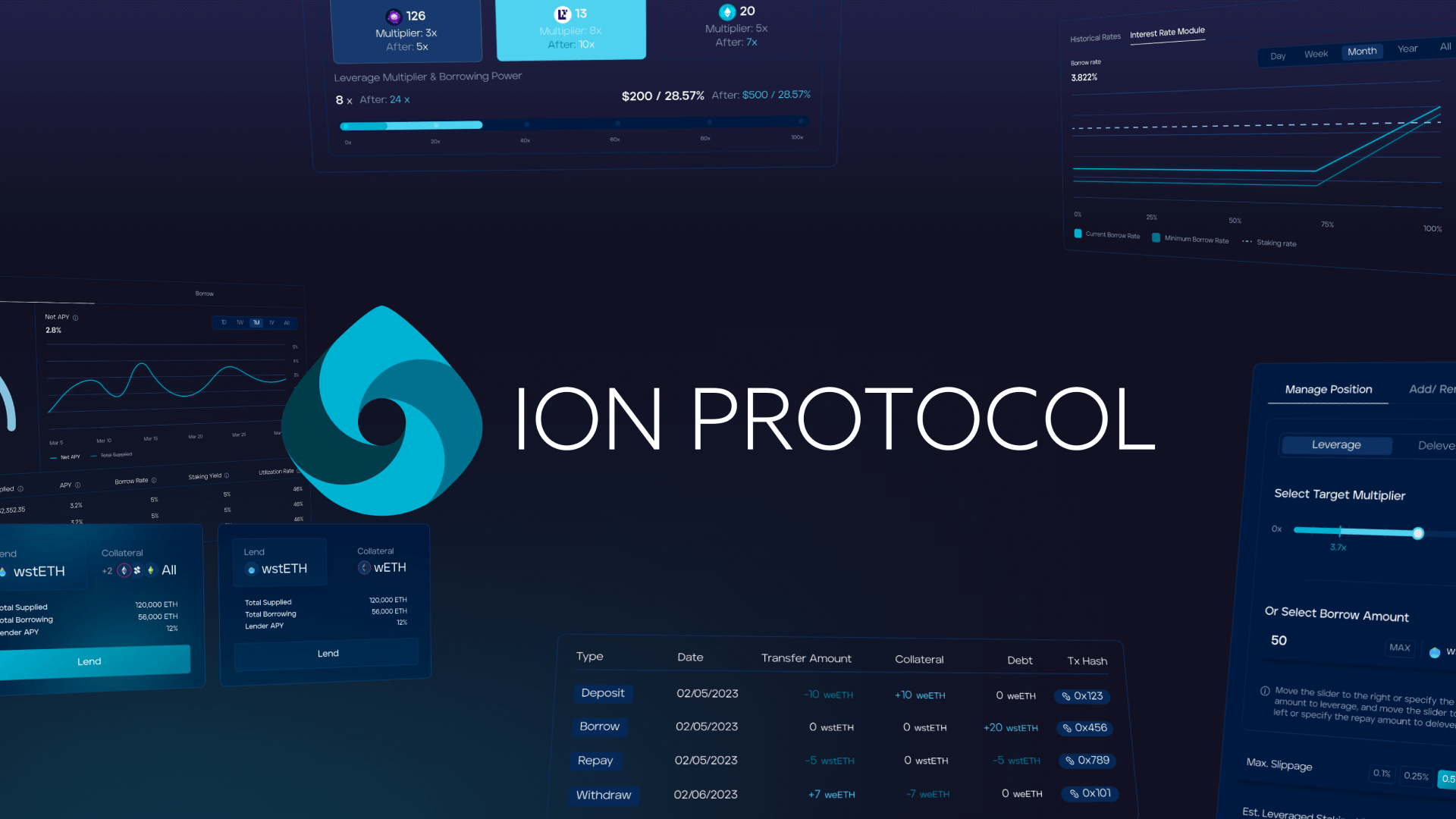

We’ve created Ion to be the best platform for earning with staked and restaked assets as collateral. With stETH, it’s possible to earn up to an estimated 15% APR in staking yield on Ion without having to worry about price liquidations.

Two innovative mechanisms make this possible: Precision which verifies the ETH staked in Lido’s validators, and Clarity, predicting slashing volatility within Lido’s validator set.

These innovations are the backbone for our price-agnostic liquidations and staking-specific interest rates. Using Precision, liquidations will only occur if slashing events reduce Lido’s validator reserves, leading to a decrease in value for stETH as collateral in our system. This will reduce the volatility experienced by borrowers, greatly reducing the chances that you lose your capital while maximizing your staking returns.

Our staking-specific interest rates are reactive to Lido’s staking yield, enabling borrowers to earn without having to worry about changes in the staking rate reducing their profitability. All the while, Clarity informs us of potential shortfalls in Ion’s validator reserves due to slashing events, making sure that the stETH in our market is parametrized accordingly.

These innovations help us provide a more capital-efficient and secure borrowing and lending experience for stETH holders. By creating a price-agnostic platform and by taking an asset-specific approach to lending market design, we’ll enable the highest yields possible for those who want to compound their stETH yield.

What’s Next?

Now that we’ve announced all the integrations we’ve lined up for launch, it’s time to follow through…

- Testnet V2 Launch (Jan 8th)

- Whitelisting Goes Live (Mid Jan)

- Hats Finance Audit Competition (Jan 22nd)

- A New Spendable Points System (Late Jan)

- Beta Mainnet Launch (Early Feb)

Be among the first to experience how Ion Protocol empowers stETH holders with price-agnostic liquidations, dynamic staking rates, and heightened security, to deliver a superior borrowing and lending platform.

Next stop, Testnet V2!