Protocol Announcement:

Ion Protocol: Testnet V2

Welcome to Testnet V2

The time has finally come. Today we’re releasing Ion Protocol’s testnet to the public—it’s time to reveal what we’ve been working on behind the scenes.

Here’s a timeline of what’s to come:

- A New Rewards System — Points & More (Mid Jan)

- Hats Finance Audit Competition (Jan 22nd)

- Beta Mainnet Launch (Early Feb)

Below we’ll share how to use the testnet and an overview of the different features we’re going to market with, but first, a summary of who we are.

What is Ion Protocol?

Ion Protocol is a lending and borrowing platform built specifically to support staked and restaked assets. Our vision is to create a unified market to empower stakers’ and restakers’ collateral as the de-facto store of value in DeFi. We aim to provide our users with the best platform available to earn with their LSTs and restaking positions.

Getting Started

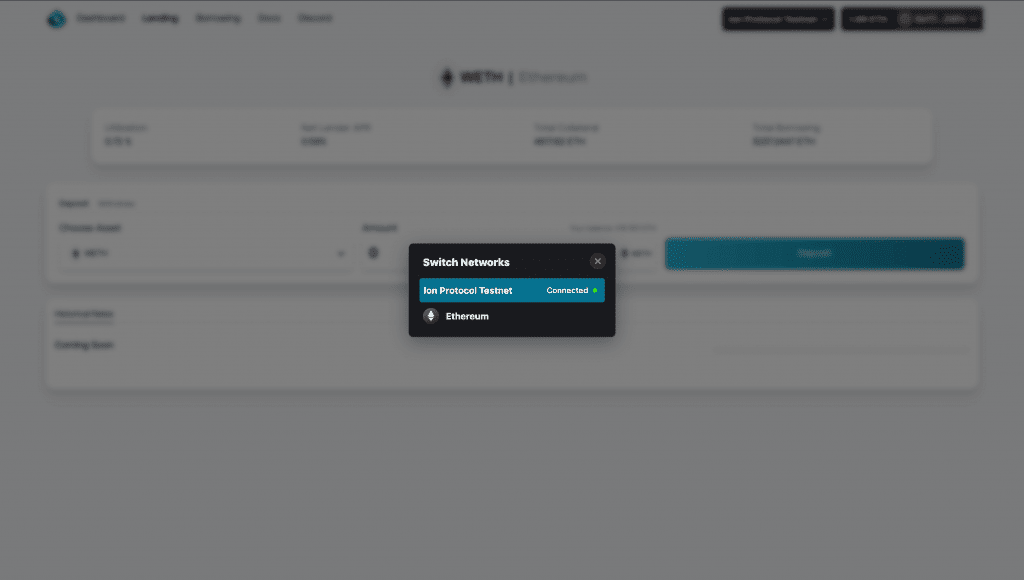

When you first arrive to the webapp, you’ll connect your wallet and switch networks to Ion Protocol Testnet.

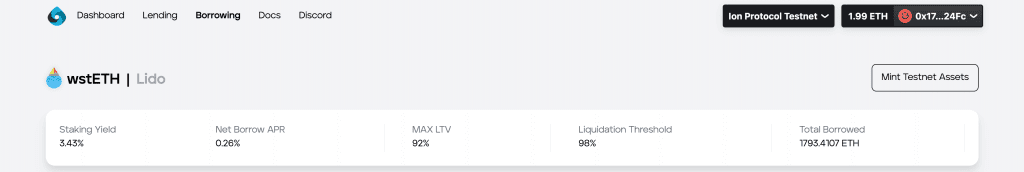

Then go to the Borrow page to mint your testnet tokens.

Features

Upon entering Ion Protocol, you can access up to three products: Lend, Earn, and Borrow.

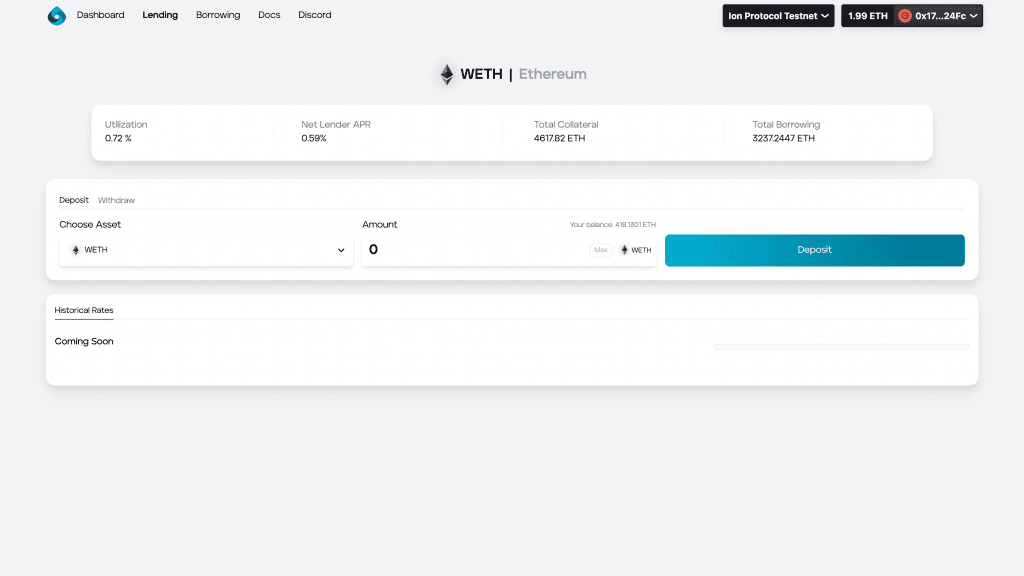

Lend

In Ion Protocol, everything begins with ETH liquidity. By depositing and supplying ETH or WETH, lenders earn the yield from borrowing activities. When the staking yield increases or when we introduce new markets with higher-yielding collaterals, the interest paid from those markets gets passed on to lenders.

Steps to Lend:

- Select the amount of ETH you want to deposit

- Click Deposit

- Confirm the transaction

- Now you’re lending to Ion Protocol!

Earn

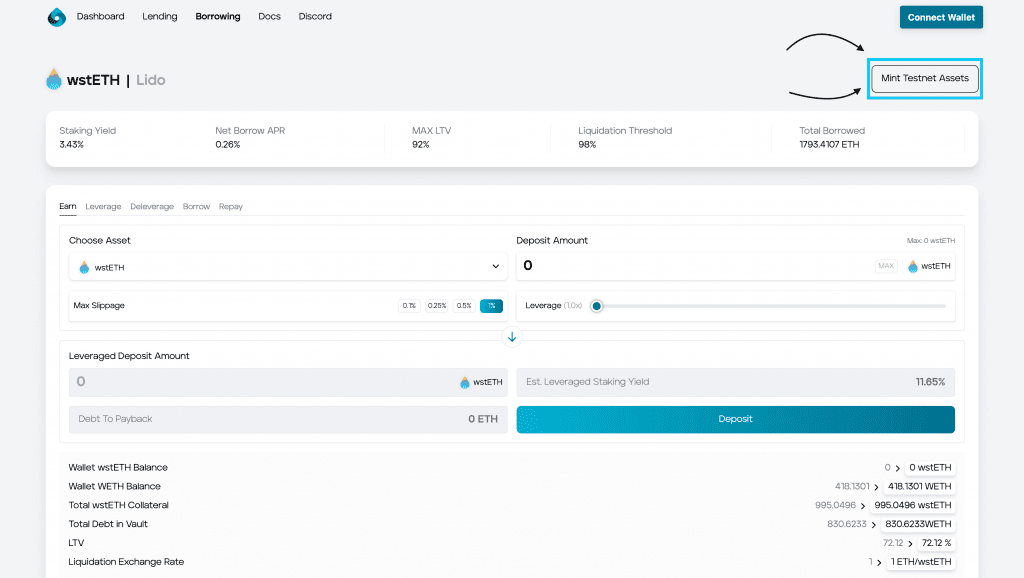

When you first open the Borrowing page you’ll find market-specific data. This data tells you more about the state of the borrow market that you’re interacting with, including details like the max LTV, total borrowed, and the net borrow APR.

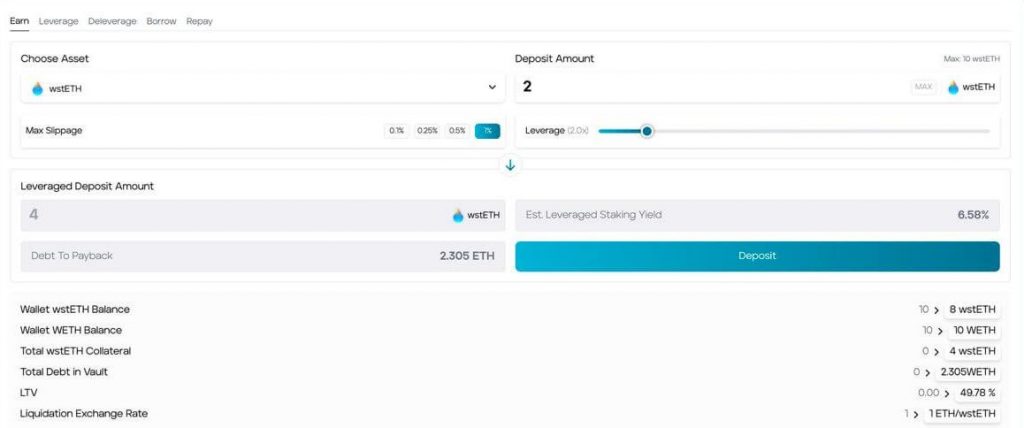

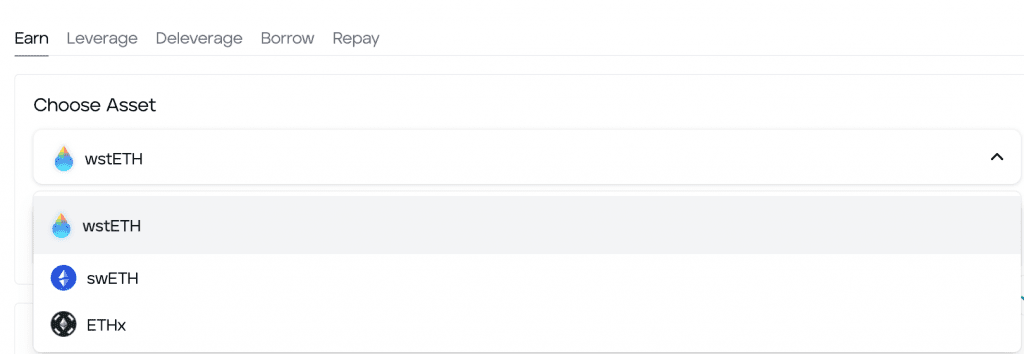

Scrolling down you’ll find the position creation dashboard. The first tab is the Earn tab. At the launch of testnet, you can Earn with wstETH, ETHx, and swETH. In the Earn tab, you can leverage loop your collateral to compound your staking yield. Ion’s market parameterizations are collateral-specific, which means each market has its own interest rate curve, LTV, and estimated staking yield. Choose what’s right for you!

Steps to Earn:

- Select the market you want to Earn in

- Input the amount of collateral you want to deposit

- Slide the leverage slide to your preferred multiple

- Verify the leverage deposit amount, the leverage staking yield, and the debt to pay back for your position

- Click deposit and confirm the transaction to begin earning leveraged staking yield!

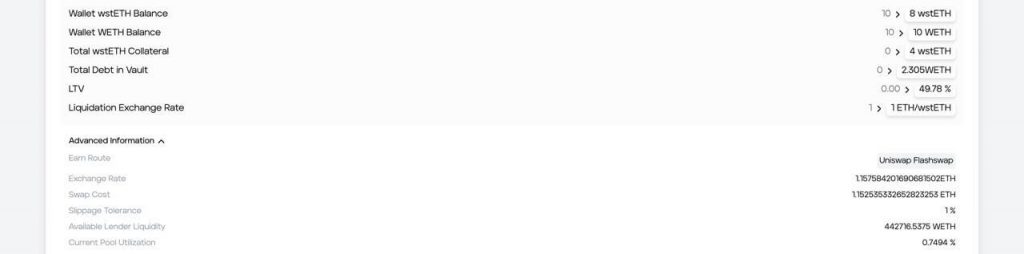

To maximize capital efficiency and ease of use, we’ve implemented flash loan-based strategies. All you have to do is select your desired max slippage and adjust the slider to indicate how much you’d like to multiply your collateral and the staking yield. Below the position creation module, you’ll find basic and advanced information regarding the position creation, the market, and your wallet.

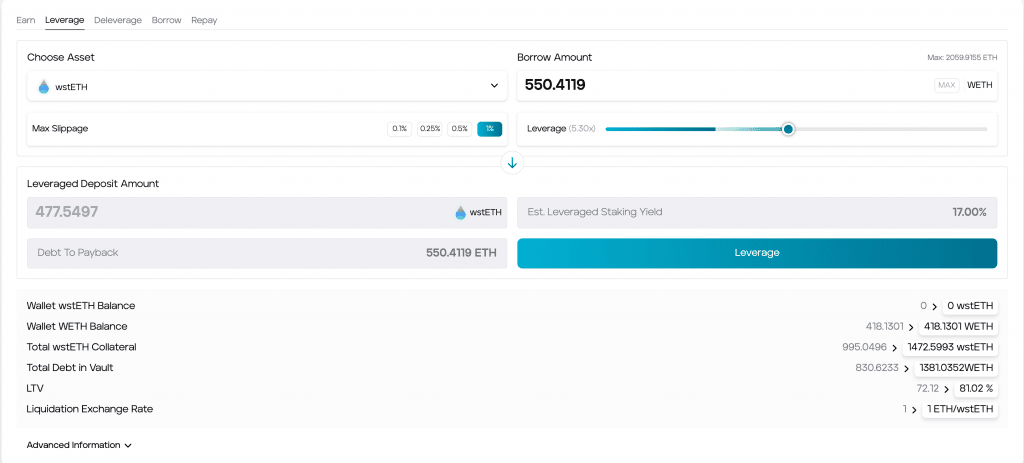

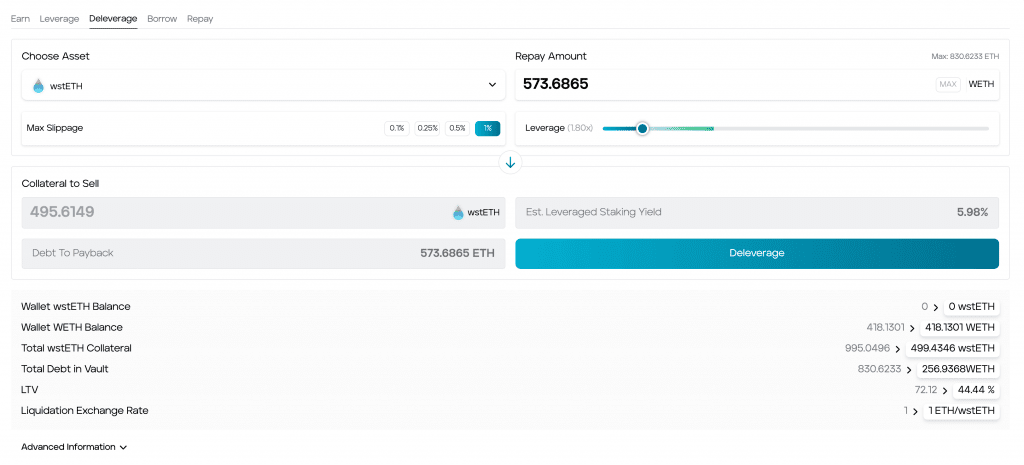

Under the leverage tab, you can increase your position size by using the leverage slider. Under the deleverage tab you can reduce your position by using the leverage slider. Under both tabs, you’ll find the same information as you did under the Earn tab.

Steps to Add Leverage:

- Select the market for which you already have a position open and want to increase your leveraged staking yield

- Slide the leverage slider to your preferred multiple

- Verify the leverage deposit amount, the leverage staking yield, and the debt to pay back for your position

- Click deposit and confirm the transaction to increase your leveraged staking yield!

Steps to Deleverage:

- Select the market for which you already have a position open and want to decrease your leveraged staking yield

- Slide the leverage slider to your preferred multiple

- Verify the leverage deposit amount, the leverage staking yield, and the debt to pay back for your position

- Click deposit and confirm the transaction to decrease your leveraged staking yield!

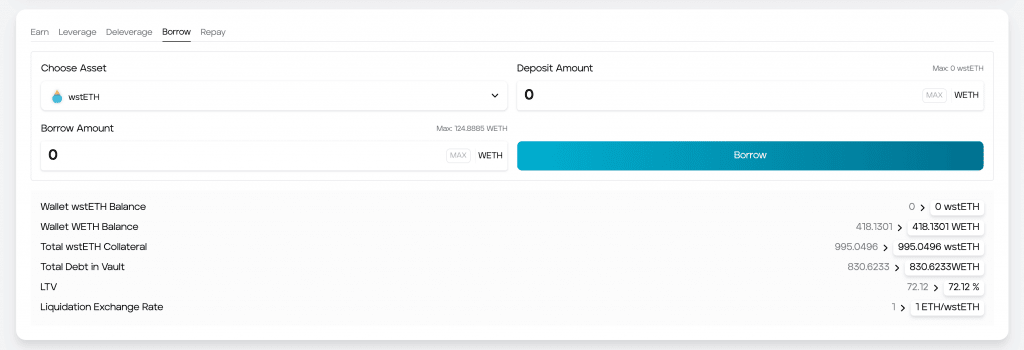

Borrow

The Borrow tab is very similar to the Earn tab, however, you’ll notice there is no leverage slider and max slippage input. In the Borrow tab, you’ll be able to borrow ETH against wstETH, ETHx, and swETH in the most capital-efficient markets available for these collateral types.

Steps to Borrow:

- Select the market you want to Borrow in

- Input the amount of collateral you want to deposit

- Input the amount WETH you want to borrow

- Click deposit and confirm the transaction to begin borrowing!

Join Us on the Journey to Mainnet!

In a previous article, The Vision Behind Ion Protocol, we went deep into how we made this all possible. Now it’s time for you to experience firsthand the product behind the vision. Here are some steps you should follow:

- Follow Ion Protocol on Twitter and join the Discord

- Join the testnet and connect your wallet

- Lend your testnet ETH

- Earn by leverage looping your testnet stETH, ETHx, or swETH

- Borrow ETH against your testnet stETH, ETHx, or swETH

- Leave us a review and any feedback in the Testnet Feedback channel in Discord!

Looking forward to hearing all of your feedback!