The Vision Behind Ion Protocol

Building the Lending Market to Scale Staking and Restaking Across DeFi

A New Frontier — Introducing Ion Protocol

Over a year ago, our team first encountered the concept of restaking, and we soon became enamored with what we believe is the next step in the evolution of ETH as an asset, further expanding on Ethereum’s role as the global settlement layer. We designed Ion Protocol to be the vanguard of innovation for the staking ecosystem and to become the most performant platform in DeFi supporting staked and restaked assets.

Prior to diving into the vision behind Ion Protocol, we will first provide context on the current state of the liquid staking and restaking ecosystem. We will then unveil what we believe to be the largest obstacles impeding the growth of the restaking ecosystem and how Ion Protocol will address them. We will also take a closer look into all the benefits that Ion will enable for stakers and restakers alike, the mechanisms behind the protocol, and what to expect from us in the near future. Let’s get started.

The Birth of a New Ecosystem — Staking & Restaking

Staking has been one of the largest and fastest-growing sectors in DeFi over the past year, scaling to over $60B in staked capital from less than $20B at the beginning of 2023. Following this growth, restaking platforms such as EigenLayer have been able to generate over $1B+ in deposits with the promise of enabling Ethereum stakers to use their assets to secure external networks. These users, known as “restakers,” earn additional rewards on top of their ETH staking rewards from the additional networks that utilize Ethereum security. Similar to the concept of slashing on Ethereum, restakers take on additional slashing risks by opting into these networks. The core features of rewards and slashing, though simple concepts at face value, exist as the backbone of how restaking provides value to staked asset holders…and how it can introduce new forms of risk.

As these networks begin to go live, the anticipation of growth around the restaking vertical has inspired the rise of products meant to lower the barrier of entry for users who want to restake. These products are known as Liquid Restaking Tokens (LRTs), which receive staked asset deposits and create liquid representations of restaking positions. LRTs help users restake to multiple networks simultaneously, decreasing the friction of entering into complex restaking positions. When you enter into a restaking position with multiple AVSs, though you can receive the rewards that these services generate, you become exposed to the slashing risks and conditions of each service the position has exposure to. This dynamic of entering into multiple restaking positions creates a looming problem tied to the innate properties of the positions themselves—the difficulty of assessing the risk related to compounding slashing exposure and the liquidity fragmentation that is a byproduct of the asymmetric risk present between restaking positions.

Scaling Restaking — Breaking Down the Barriers to DeFi Adoption

Currently, determining whether or not a staked asset is stable enough to be used widely in DeFi depends heavily on the presence of active counterparty liquidity in AMMs. Without deep liquidity, it is difficult for protocols to properly price each asset and ensure its economic stability. Unfortunately, there are multiple innate properties that staked and restaked assets possess that make it difficult for liquidity dependent risk underwriting to be efficient and effective.

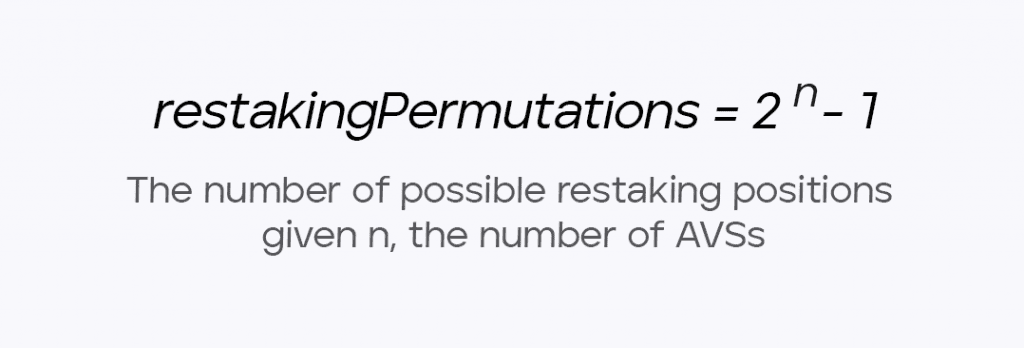

As mentioned in the previous section, both staked and restaked assets are subject to slashing events that can occur due to a variety of factors. This inherent property, in addition to the number of potential permutations of restaking positions that can exist, decreases the fungibility between them as assets of unlike risk profiles are not fungible with another. This lack of fungibility between restaked assets can introduce liquidity fragmentation in LP-based pools as these assets will exist separately from one another in different liquidity environments.

When viewing this dynamic within the pre-existing context of the sustainability of LST/ETH-based liquidity provisioning, the issue becomes significantly starker. LST/ETH AMM pools are considerably difficult to incentivize effectively without providing considerable external rewards. This is due to the fact that users LPing into LST/ETH LP positions must give up half or more of the staking yield they could be earning if they were directly staking or restaking instead. Since the cost to enable LST liquidity is often placed on the protocol issuing the asset, the financial burden it places on protocol treasuries to pay out LP rewards limits the ability to scale deep counterparty liquidity in the long run, hindering protocol adoption in DeFi.

While liquidity fragmentation creates an initial barrier to the adoption of staked and restaked assets at scale, the property of slashing itself generates another roadblock—the difficulty of factoring in slashing risks. The traditional pricing of liquidity risk derived from robust AMM counterparty liquidity do not reflect the slashing risks that staked and restaked assets assume by being restaked. Barriers to the visibility of slashing events and opacity around potential compounding slashing risks simply aren’t addressed in the current status quo methodologies employed to underwrite collateral risk.

Combined with the fact that staked and restaked assets can always be redeemed into the Ethereum consensus layer regardless of the external market price, these factors demonstrate that classical liquidity-dependent risk underwriting is not the best approach to assessing the risk-adjusted value of restaked assets. Recognizing the significance of these barriers, we immediately realized the need for innovation surrounding staked and restaked asset risk underwriting that optimizes the economic outcomes of stakers and restakers by addressing their unique characteristics directly.

Welcome to Ion — The Lending Market for Staked & Restaked Assets

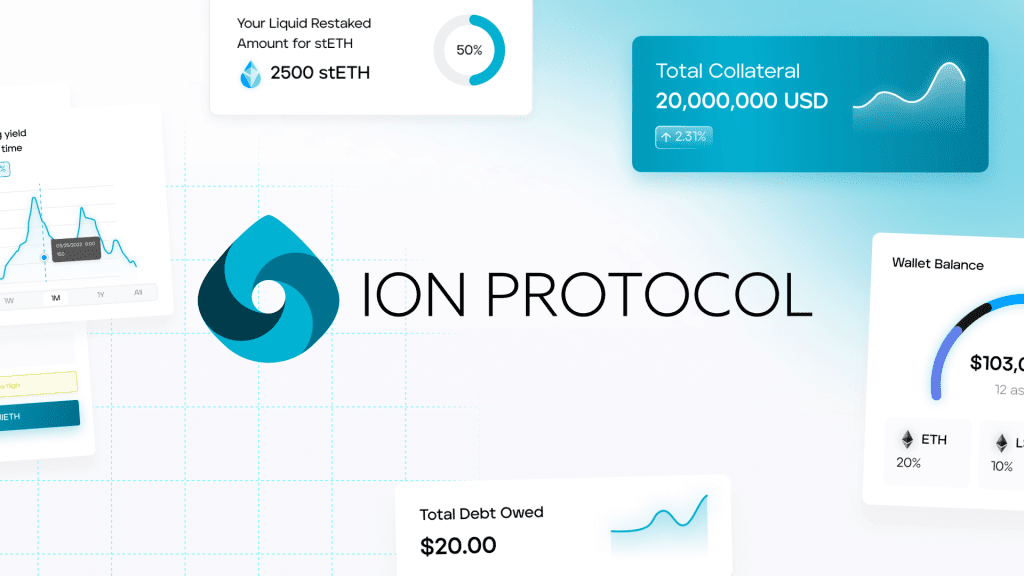

Enter Ion Protocol. Ion is a lending and borrowing protocol (AKA money market) specifically built to support staked and restaked assets. Our vision is to create a unified lending and borrowing market to empower stakers’ and restakers’ collateral as the select asset in the DeFi ecosystem. We aim to provide our users with the best platform in DeFi to earn with their LSTs and restaking positions. To facilitate this hyper-efficient and asset-native financialization, we index on four main user benefits that we aim to achieve.

- Maximizing Capital Efficiency

- Minimizing User Exposure to Risk

- Supporting Any Staked or Restaked Asset

- …All the while indexing on a superior user experience

To better understand how our approach ties in with the benefits that we just outlined, we will introduce some of the primitives we have built to alleviate the barriers around scaling access to staking and restaking. Then, we will leave you with some news on what to expect from us soon and how you can get involved with Ion moving forward. Let’s get into it.

The Nuts and Bolts — What Makes Ion Work?

The main objective of Ion’s architecture is to tackle the challenges associated with staked and restaked assets that cause inefficiencies in current DeFi markets. To achieve this objective, we have developed a range of innovative mechanisms that can be divided into two categories—infrastructure-based mechanisms and DeFi-based mechanisms.

Infrastructure-based Mechanisms

Visualizing Solvency and Risk – Precision

Precision is a network of data feeds enabled by provider-supported, internally managed, and trustlessly proven validator data. Precision keeps track of the ETH balance in the validators of a collateral asset’s provider set; made verifiable via ZK state proofs. Using this information, we generate an exchange rate to value staked and restaked assets agnostic to their market price and instead, by tracking their internal solvency. This exchange rate removes price volatility from collateral valuations, enabling us to increase LTVs compared to what current markets can provide. It also enables us to design liquidations to be triggered by changes in consensus layer state, not by price.

Analyzing Infrastructure Risk, At Scale – Clarity

Clarity is a risk analysis engine powered by ZKML that generates validator credit ratings to analyze the propensity of validator subgroups to be slashed. This enables us to properly monitor the performance of many validators on the beacon chain. By monitoring this activity, we can aggregate provider metrics to better underwrite staked and restaked asset markets and enable higher LTVs and lower borrow rates.

DeFi-based Mechanisms

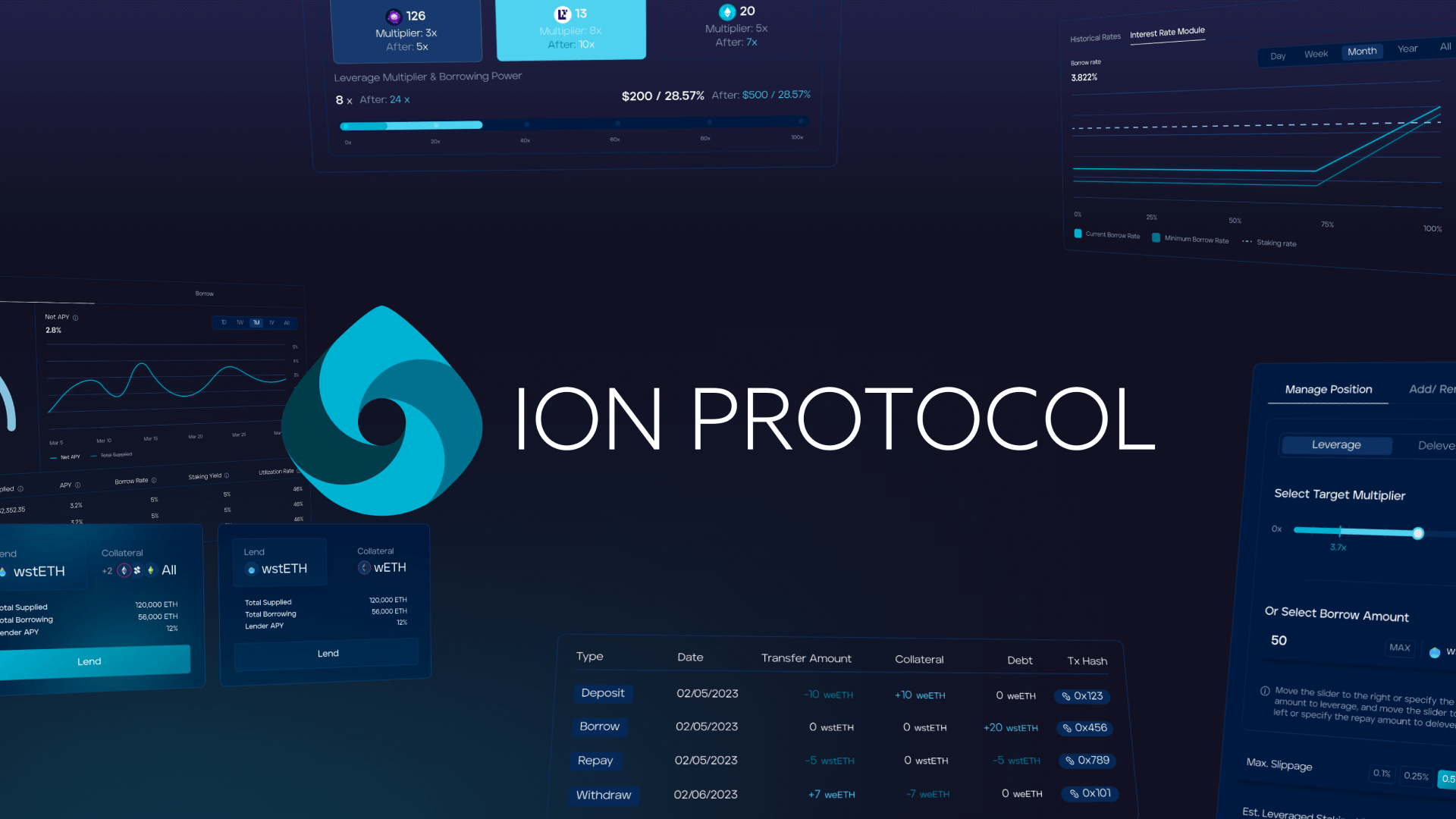

Yield-reactive Interest Rates

To minimize the volatility of return rates for assets earning validator-correlated staking yield, we’ve tailored Ion’s interest rate curves to be bounded relative to the current staking rate of the underlying collateral assets. Effectively, this enables borrowers who are looking to leverage on the yield of their staked assets to earn a more predictable rate while lenders can be assured that they are earning the most competitive yields possible, given the demand for the collateral asset.

Staking-specific Liquidations (AKA price-agnostic)

Liquidations on Ion Protocol take into consideration the underlying value of ETH present in validators that back a representative staked or restaked asset mapped to the validators’ balance. This enables Ion to liquidate positions by assessing changes in the underlying balances of the validators backing a collateral vault rather than by volatile price action. Additionally, because slashing events are inherently more discrete events in comparison to price decreases, they tend not to cascade in a short amount of time (except for correlated slashing events under network-wide collusion). Ion opens dutch auctions against liquidatable positions to liquidate only the amount of borrower collateral necessary to bring back the vault to a target health ratio, enabling safer loans with minimized liquidation impact for borrowers.

These features in tandem (plus more we’ve yet to announce) enable Ion to be the most capital-efficient and risk-mitigated lending platform for staked and restaked assets in the market, enabling new use cases for staked and restaked assets all across the DeFi ecosystem (more on this in a future piece!).

The Next Steps — What to Expect from Us

We are so excited to bring Ion to market in the new year. Over the next two months, make sure to tune into the several large announcements that we’ll be making as we bring Ion to mainnet. We want to bring our vision to you directly, allowing you to take part in the action every step of the way. Here’s what to expect.

- Testnet V2 Launch (Jan 8th)

- Whitelisting Goes Live (Mid Jan)

- Hats Finance Audit Competition (Jan 22nd)

- A New Spendable Points System (Late Jan)

- Beta Mainnet Launch (Early Feb)

The rise of restaking and LSTFi has only just begun. We’re working to bring you access to the best lending and borrowing experience for restaking, liquid staking, and a plethora of other exotic staked asset representations. Expect more from us soon on how you can use Ion to make the most of your staked and restaked assets (hint—20%+ est. staking yield + compounded EigenLayer points!). Until then, it’s back to building for us, see you soon…