Partnership Announcement:

Welcoming Modulus to Ion’s Lab

Welcoming the next partner to the Ion Protocol ecosystem, our collaboration with Modulus Labs marks a significant milestone in our product development. Over the past several months, we’ve worked extremely closely with their team to develop Clarity – our Zero-Knowledge Machine Learning (ZKML) framework – the 1st in the world built to underwrite validator-backed assets through the creation of unique credit risk profiles for validator groups.

This partnership combines our expertise in understanding the implications of low-level Ethereum architecture on validator-backed asset risk and Modulus’ focus on building ML-optimized ZK proving systems. More than just a technological breakthrough, however, our collaboration is redefining the standards of security, trust, and capital-efficiency in DeFi; the joint venture is a testament to our commitment to delivering a protocol that intuitively aligns with the needs and aspirations of its users, while also being robust and reliable.

Modulus and ZKML-native Proving Systems

Modulus is the leading voice in the nascent field of Zero-Knowledge Machine Learning—a method of giving protocol users cryptographic confidence that AI results are never manipulated or doctored. Since their debut, Modulus has released the world’s 1st ZK proven AI projects, papers, and large scale integrations. In particular, their Stanford-based team of AI researchers and cryptographers are pioneers of specialized ZK provers—zero-knowledge proving systems purpose-built for artificial intelligence. This allows their proving pipeline to bring AI features on-chain at massive scale, without sacrificing a single ounce of blockchain security.

And it is precisely thanks to our deeply focused collaboration that together, we’re excited to announce that the Ion and Modulus integration will be one of the largest ZKML applications ever implemented on-chain. This means bringing hundreds of thousands of AI predictions on-chain to the Ion protocol, every single week—a truly staggering milestone. Stay tuned in the weeks to come as we unveil more about Modulus’ specialized prover, and how its next generation architecture is bringing trustless AI to Ion. But first…

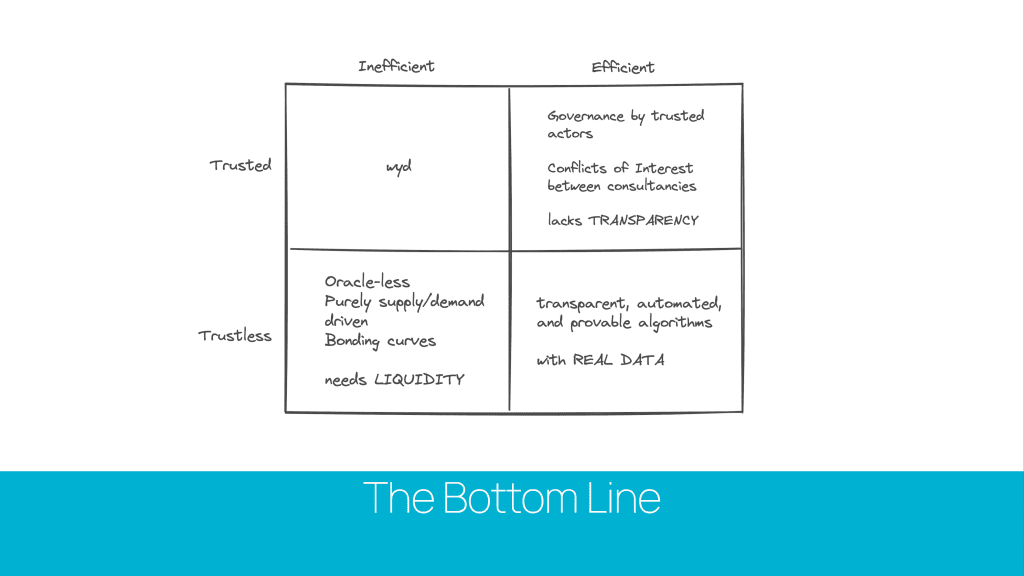

The Big Why For ZKML

At the heart of our collaboration with Modulus lies a shared vision: to revolutionize how we think about risk underwriting in DeFi. Our model is designed to be a cornerstone in our system architecture, offering unparalleled reliability and security when it comes to slashing prediction and liquid staking provider (LSP) risk underwriting. Our primary objective is to harness the potential of asset-specific primitives tailored to validator-backed assets (VBAs). Thus, ensuring that each market Ion Protocol parameterizes and underwrites is uniquely suited to its collateral and the infrastructure supporting it.

We know that in order to contribute to ETH’s Proof-of-Stake (PoS) infrastructure, validators must stake 32 ETH and make credible commitments (AKA attestations). That is, validators must commit to following the rules outlined by ETH’s PoS system, and if they depart from these rules they are no longer considered credible by the network. A deviation from these rules, and subsequent loss of credibility, materializes in a slashing event that immediately burns a part of the 32 ETH. The slashed stake is then subject to a correlation penalty depending on the amount of other validators slashed within a specific time window, ultimately culminating in a forced exit for the slashed validator from the Beacon Chain.

The assurance of credible commitments is extremely crucial to liquid staking provider and middleware design, even bolstering competition amongst LSPs and forcing them to innovate and implement new ways to protect against slashing. It’s important to understand that this effort will become significantly more in demand with the rise of EigenLayer and other such restaking positions, since a validator must opt in to additional credible commitments in order to restake their capital. Building a system that isolates this endogenous risk vector, properly assesses it’s effect on VBAs, and most importantly, trustlessly conveys the insights it generates towards the capital markets on Ion, is what will enable us to provide the best outcomes (more capital efficiency, less risk, and more asset support) to you, our users.

How it Works

Since we’ve taken an asset-specific approach to constructing Ion Protocol, we’ve tailored collateral valuations to reflect the importance of credible commitments and capital staked. To do this, we’ve developed an internal tracking mechanism via ZK-state proofs (more on this soon!) to value collateral assets based on the amount of ETH staked within their validator set, wherein collateral values decline strictly as a result of slashing.

Concurrently, we’ve built out our proprietary machine learning model with the objective of analyzing the validator sets of LSPs that we support. The model was constructed in a way that analyzes the infrastructure and performance history of individual validators within an LSPs validator set to predict and quantify the probability of slashing in a periodic fashion. This works hand in hand with our specialized beacon chain underwriting mechanism to better identify and warn us of anomalous price declines. With this information we can then extend the results of the model to qualify the riskiness of the LSP.

Combining these two primitives helps us fulfill the need mentioned before of properly underwriting VBAs and qualifying them accordingly. This approach is centered around enhancing user experiences, striking a balance between lower risk and higher rewards. We need robust and trustless underwriting to do this right; in a way that’s both DeFi and ETH aligned. By eliminating intermediaries, we not only streamline processes but also bolster security, making DeFi more accessible to holders of VBAs.

Benefits of the Integration

This integration is critical to Ion’s stack as we’ve designed our lending markets to be more asset-specific than other incumbent lending protocols. By understanding and quantifying the slashing risk of a validator set we can use this information to assist in parameterizing the interest rates, LTVs, and other market details to ensure that we are minimizing the risk exposure to anomalous slashing risks.

Modulus is deeply excited by this vision, and we are ecstatic to be publicly unveiling our work together. In the meantime, check out a sneak peak of our integration dashboard, and stay tuned for more about the work we’re doing around Clarity coming soon.

Towards the Future

The road to any new kind of financial product ought to be filled with cutting-edge research, fierce debate, top notch engineering, and robust testing. To our team and our ecosystem of partners, however, the struggle has been an easy trade for the opportunity to create a primitive which fundamentally changes the way LSPs are classified. The result: the shifting of demographical concentrations to those with the best advantage—longer tail assets should not be diminished as a factor of illiquidity. Furthermore, they shouldn’t be constrained to the same kind of disadvantages of illiquidity when they would otherwise present outstanding ratings.

Our vision is to create a platform that serves a wide variety of users, securely maximize the benefits of their positions across a large spectrum of risk appetites. And we are making this possible through primitives which have been designed to directly cater to VBAs: leading to the creation of the leading protocols that provide native risk adjusted yield to our markets’ participants.

A bright future awaits, anon…

Links

Website: https://www.moduluslabs.xyz

Docs: medium.com/@ModulusLabs

Twitter: https://twitter.com/ModulusLabs

Modulus Explorer: https://explorer.modulus.xyz

Learn more about ZKML: https://fortune.com/crypto/2023/05/04/artificial-intelligence-zero-knowledge-proofs-zkml-verify-ai/?zkmlai